[!TIP] New in 0.28:

Plotly 6 support

ticker_kwargsinYFDataFixed Pandas TA dependency (→ pandas-ta-classic).

Updated apps and Docker images

📦 Installation

To install optional dependencies as well:

✨ Usage

VectorBT lets you backtest strategies in just a few lines of Python.

Profit from investing $100 in Bitcoin since 2014:

Buy when the 10-day SMA crosses above the 50-day SMA, and sell on the opposite crossover:

Generate 1,000 strategies with random signals and test them on BTC and ETH:

For hyperparameter optimization fans: test 10,000 window combinations of a dual-SMA crossover strategy on BTC, ETH, and XRP:

Inspect any strategy configuration by indexing with pandas:

Same goes for plotting:

It's not all about backtesting! VectorBT can also help with financial data analysis and visualization.

Create a GIF that animates Bollinger Bands %B and bandwidth across multiple symbols:

This is just the tip of the iceberg. Visit the website to learn more.

🕹️ Apps

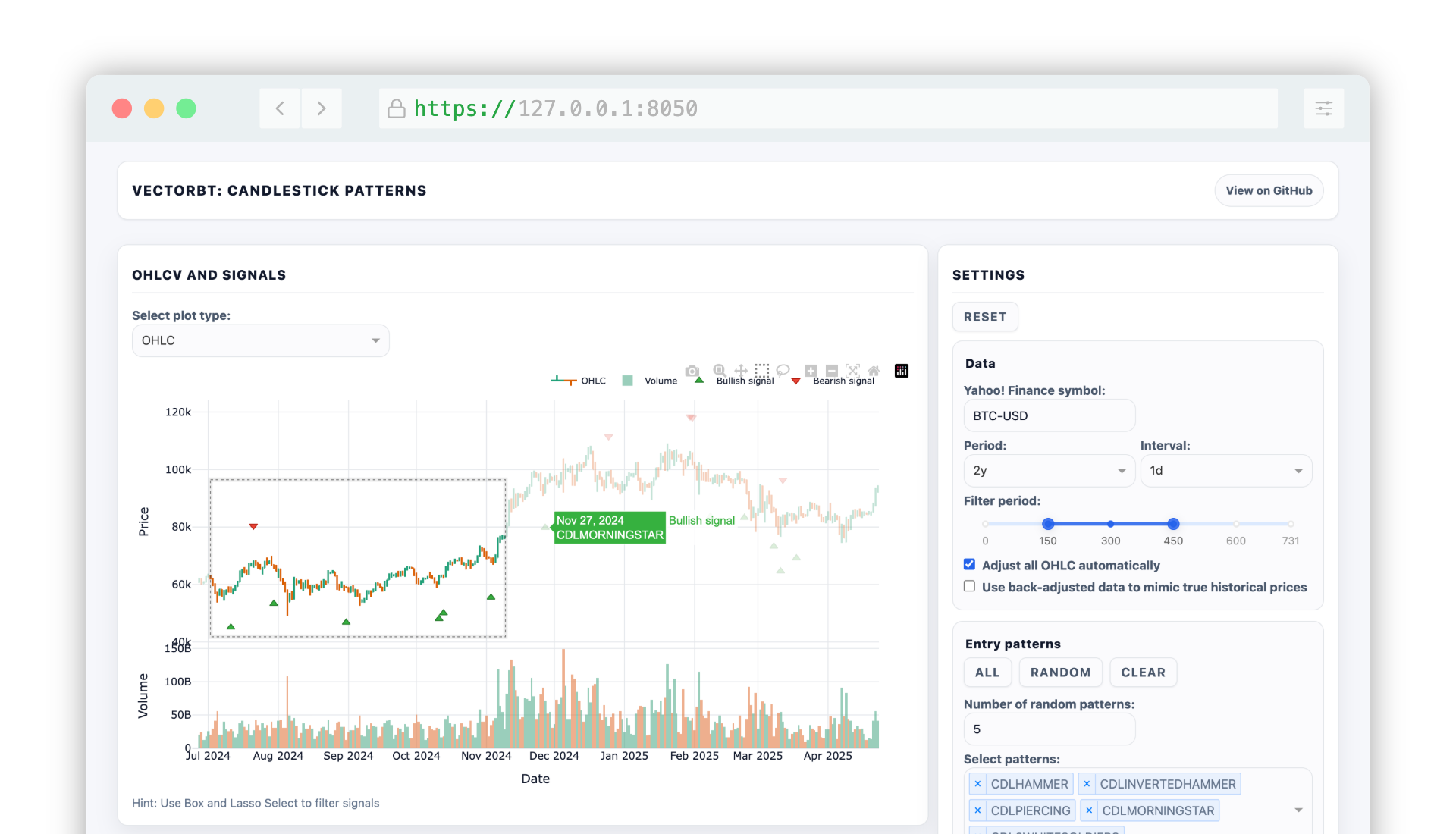

Candlestick Patterns (here)

Explore candlestick-pattern signals interactively and backtest them with VectorBT.

🔗 Links

⚖️ License

This work is fair-code distributed under the Apache 2.0 with Commons Clause license.

The source code is open, and everyone (individuals and organizations) may use it for free. However, you may not sell products or services that are primarily this software.

If you have questions or want to request a license exception, please contact the author.

Installing optional dependencies may be subject to a more restrictive license.

⭐ Star History

⚠️ Disclaimer

This software is for educational purposes only. Do not risk money you cannot afford to lose.

USE THE SOFTWARE AT YOUR OWN RISK. THE AUTHORS AND ALL AFFILIATES ASSUME NO RESPONSIBILITY FOR YOUR TRADING RESULTS.